Healthcare IT Compliance as a Security Strategy & Recovery Launch-Pad

Healthcare organizations operate in one of the most regulated industries in the world. Compliance is not optional; it is a critical component of patient safety, data security, and financial integrity. With rising cyber threats and evolving regulations, understanding healthcare compliance and security is essential for every provider, insurer, and IT leader.

Table of Contents

- What is Healthcare Compliance & Security

- Cybersecurity Threats to Healthcare

- Key Healthcare IT Compliance Regulations

- Emerging Trends for Healthcare Compliance 2025

- Biggest Challenges in Healthcare Compliance

- Steps to Strengthen Compliance & Reduce Risk

- Cyber Insurance and Healthcare IT Compliance

- Investing in Healthcare IT Compliance Services

- Conclusion

What Is Healthcare Compliance and Security?

Healthcare compliance refers to the process of adhering to laws, regulations, and ethical standards that govern patient care, billing practices, and data privacy. It ensures that healthcare organizations meet legal obligations while maintaining trust and transparency.

Healthcare security focuses on protecting sensitive health information and IT systems from unauthorized access, breaches, and cyberattacks. Together, compliance and security create a framework that safeguards patient data and ensures operational continuity.

Cybersecurity Threats to Healthcare

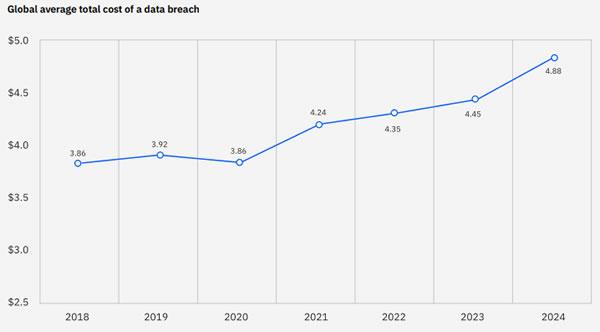

Healthcare is a prime target for cybercriminals due to the high value of patient data and the critical nature of healthcare services. In recent years, the cost of a healthcare data breach has surpassed $11 million, making it the most expensive among all industries.

Major Threats Include

- Ransomware Attacks: Locking systems and demanding payment, often disrupting patient care.

- Phishing and Social Engineering: Exploiting staff to gain access credentials.

- Cloud Vulnerabilities: Misconfigured cloud environments exposing sensitive data.

- Medical Device Exploits: Connected devices like infusion pumps and pacemakers are vulnerable.

- AI-Powered Attacks: Cybercriminals using AI to launch sophisticated breaches.

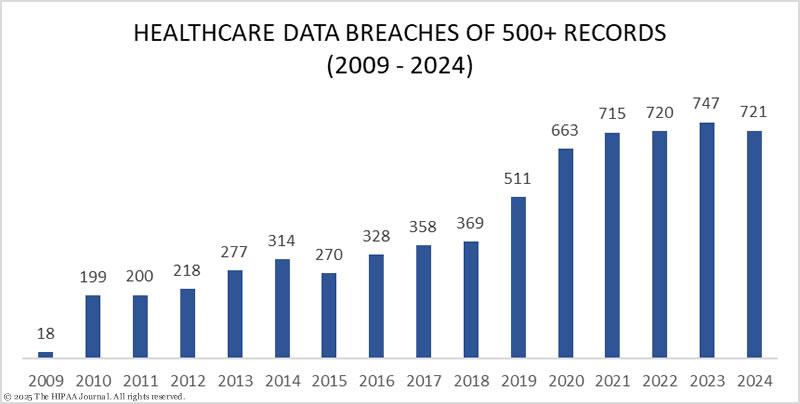

Source: The HIPAA Journal

Top 3 Reasons Healthcare Is a Prime Target

- Patient data is worth up to 40 times more than credit card information on the black market.

- Complex IT ecosystems with legacy systems and IoT devices.

- Downtime can endanger lives, making organizations more likely to pay ransoms.

Source: The HIPAA Journal

Key Healthcare IT Compliance Regulations

Health Insurance Portability and Accountability Act (HIPAA)

Sets standards for storing, sharing, managing, and recording personally identifiable health information (PHI) through the Security, Privacy, and Breach Notification Rules; any entity handling healthcare data or software must comply with these safeguards.

HITECH Act

Enforces HIPAA’s privacy and security rules for electronic health information, promotes EHR adoption through financial incentives, requires security audits, and mandates breach notifications.

FDA Regulations

Oversees medical devices and related software, requiring cybersecurity measures and premarket submissions for safety-impacting changes.

GDPR (General Data Protection Regulation)

Applies to organizations handling EU citizen data, enforcing strict consent and privacy rules.

3 Emerging Trends for Healthcare Compliance 2025

1. Interoperability Requirements

APIs for real-time data exchange are becoming mandatory under CMS and ONC rules. By 2027, payers and providers must implement FHIR-compliant APIs for patient access, provider access, and payer-to-payer data sharing, setting a new standard for seamless health information exchange. This shift aims to eliminate data silos and improve care coordination.

2. AI Risk Management

Healthcare organizations must integrate AI governance into compliance programs. The Joint Commission and Coalition for Health AI released the Responsible Use of AI in Healthcare (RUAIH) framework, emphasizing policies for algorithm transparency, bias mitigation, and continuous monitoring. AI-related risks such as data privacy, security vulnerabilities, and regulatory uncertainty are now disclosed by over 70% of major companies, signaling the need for formal oversight structures.

3. Expanded Telehealth Rules

CMS continues to update reimbursement models for virtual care. While many pandemic-era flexibilities remain through September 2025, new rules streamline how services are added to the Medicare telehealth list and remove frequency limits for certain settings. However, geographic and facility restrictions for non-behavioral health telehealth services will return after September 2025 unless Congress acts, making compliance planning essential for providers.

The Biggest Challenges in Healthcare Compliance

Fragmented security frameworks

Many organizations have grown through mergers or rapid expansion, leaving behind a patchwork of systems and policies. Without a unified compliance strategy, vulnerabilities multiply.

Evolving cyber insurance requirements

Insurers increasingly demand evidence of risk management—such as multi-factor authentication, encryption, and incident response plans. Falling short can mean higher premiums or denied claims.

Data overload and access control

From EHRs to telehealth platforms, the sheer volume of data makes it hard to enforce consistent security. Every access point is a potential risk if not properly governed.

Third-party exposure

Vendors handling billing, imaging, or cloud hosting often have their own security standards. If those don’t align with yours, you inherit their risk.

Regulatory complexity

HIPAA, HITECH, and state-level privacy laws are constantly evolving. Staying current requires dedicated resources and expertise.

Steps to Strengthen Compliance & Reduce Risk

The key to meeting security regulation standards involves the embedding of compliance initiatives into everyday operations. Here are some incredibly beneficial steps you can take:

1. Integrate compliance into workflows:

Automated audit trails, secure messaging, and access controls should be part of the systems staff already use.

2. Align with insurer requirements:

Review your cyber insurance policy and ensure your security posture meets or exceeds their standards.

3. Train continuously:

Compliance isn’t static. Regular, role-specific training helps staff understand their responsibilities and adapt to new threats.

4. Vet and monitor vendors:

Hold partners to the same security and compliance standards you apply internally.

5. Stay proactive:

Real-time monitoring, regular risk assessments, and policy updates help prevent gaps before they become costly breaches.

6. Partnering with experts:

Accessing healthcare compliance consulting, or healthcare compliance services, can simplify this process. From policy development to technology integration, specialized compliance services ensure your organization meets regulatory obligations to both prevent breaches and position your organization for favorable cyber insurance terms.

What Healthcare Leaders Should Know About Cyber Insurance and IT Compliance

Compliance is critical for preventing cyberattacks and protecting your business and patients. But even with strong safeguards, breaches can still happen. When they do, one of the most important assets beyond Backup and Disaster Recovery, is cyber insurance. Here’s what you need to know:

Working With Cyber Insurance

Every policy is different, but all require proof that your organization meets certain compliance standards before coverage kicks in. This ensures insurers can process claims and provide the financial and reputational support your business needs to recover after an incident. Beyond ensuring coverage, meeting compliance standards for regulations like HIPAA often leads to lower premiums.

It is important to note that with cybercrime on the rise, insurers are making it harder for impacted businesses to access coverage. Meeting HIPAA or GDPR requirements may satisfy regulators, but insurers may require more. Setting real-time controls in place and performing ongoing governance, such as documented security training, periodic risk assessments, and active system monitoring are all imperative to help you ensure coverage. A “check-the-box” compliance mindset can leave you fully compliant yet uncovered when an incident occurs.

Making Cyber Insurance Work for You

Furthermore, insurance requirements and compliance regulations act as a strategic guideline for healthcare organizations seeking to bolster their security.

Insurance and compliance aren’t just obligations but if used strategically, they’re tools for building resilience. As CISO Eric Harris of the Charlie Norwood VA Medical Center explains in HealthTech Magazine:

“It’s also important to evaluate the role of cyber insurance in executive and board-level discussions. For many healthcare organizations, insurance has become a useful bridge between technical risk and strategic priorities.”

He adds: “When presented properly, the cost-benefit analysis of insurance coverage—alongside the operational investments required to qualify—can help elevate cybersecurity on the executive agenda. Framing coverage gaps as enterprise risks, rather than technical issues, is a practical way to gain buy-in for control upgrades, staff training, or third-party assessments.”

This is to say that by aligning policy requirements with desired business outcomes, healthcare CISO’s can instrumentalize cyber insurance. This strategy serves healthcare IT leaders in strengthening security posture, while simultaneously opening more investment opportunities & resource acquisitions for their department.

Investing in Healthcare IT Compliance Services

There’s more to staying compliant in healthcare than meets the… regulations. Protecting patients, safeguarding your reputation, and ensuring operational resilience are the core objectives behind the legal jargon.

Yet, we’ve seen how navigating HIPAA, HITECH, and evolving cyberthreats and cyber insurance requirements can be overwhelming for Healthcare leaders. Especially when their focused growing their business and delivering exceptional care.

This common challenge is the reason healthcare compliance services exist. From comprehensive risk assessments and policy development to secure communication solutions and ongoing governance, partnering with experts helps you close gaps, reduce risk, and build a compliance framework that works seamlessly with your daily operations.

Managed Solution has helped healthcare organizations achieve full compliance while strengthening security and positioning for favorable insurance terms. Our approach is designed to simplify complexity and give leaders confidence that their organization is protected and prepared for what’s next.

Ready to see what this looks like in action?

✅ This case study details the processes & solutions that delivered our client to compliance, improved their security posture and lead them to business growth.

Conclusion

If you’re a leader in Healthcare or IT, we understand that your field’s relationship with cybersecurity can feel like a never-ending maze of regulations, audits, and evolving threats. However, there are powerful and strategic benefits for the level of effort it takes to protect your patients, organizational reputation, and financial stability.

There is also a clear path forward. Compliance can feel like a burden, but with the right approach it can be a powerful tool. When you understand which processes, solutions, and partnerships to leverage, you’ll find you have multi-faceted safety net for your patients and continuity alike.

Cyber insurance adds another layer of reassurance, but it only works when you’ve met (and documented that you’ve met) the regulation standards. If you look at this through a lens of partnership: compliance keeps you prepared, and insurance helps you recover if the unexpected happens. Together, they give you confidence that your organization can weather any storm.

You’re not alone, either. Leveraging guidelines & resources from insurers, governing bodies and healthcare associations is a great place to start. On the other hand, by having the ability to call upon trusted experts like Managed Solution, you can streamline your compliance journey altogether.

If you found this article helpful and want to learn more. Explore our compliance services page or chat with one of our experts.